Economic

Tsunami, the Second Wave:

Prepare your portfolio for the next tidal wave

By Keith Springer

We are living in extraordinary times. The

demographics of the aging baby boomer generation and the massive

government interventions have changed the rules for investing. Over

the next several years we will be gyrating back and forth between

the different economic cycles of deflation, inflation, re-flation

and stagflation, and each will require an entirely different

investment strategy.

What’s next? Deflation! Deflation

is brought about by a systemic slowdown of an economy that brings

prices "lower" for goods and services. That is practically unheard

of in a capitalist economy, except at the end of a generational

cycle every 40

years or so, such as we are currently experiencing with aging Baby

Boomers. The situation is exacerbated by excessive leverage, which

is essentially too many people (and governments) with too much debt.

The process of resolving this excess is called “deleveraging”, the

massive elimination of credit and debt throughout the economy.

Deleveraging by design is “deflationary”, which is bad news for

stocks!

The scary part of a deflationary investment

environment is that it is completely foreign to today's investors.

Very few are familiar with what is necessary to be successful during

a deflationary period, and most will be caught dangerously short and

lose their life savings.

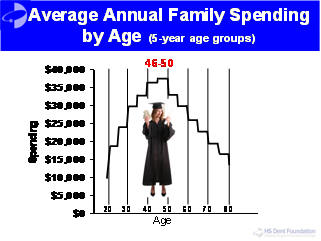

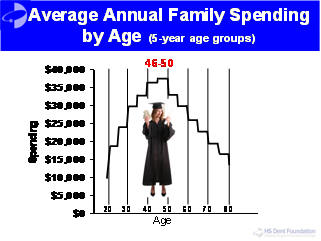

The primary cause for deflation is the

demographics of the aging Baby Boomers. Demographics tell us that:

-

People

do very predictable things at different times in their lives,

with peak spending occurring at approximately 48 years of age

-

The populations of the U.S. and the developed world are aging

-

As people age, they naturally spend less, generating less

demand for goods and services.

-

Less demand leads to decreased supply, a.k.a. production; less

supply means fewer people are needed in the workforce.

-

The deflationary spiral continues until a generation comes

along that is big enough to fill the shoes of the Baby Boomers.

-

That generation is the Echo-boomers, the children of the Baby

Boomers, who will not reach their peak spending years until

2023.

The massive deleveraging process that the

world is currently going through is undeniable.

-

US

Banks are expected to cut an additional $1.5+ trillion worth of

credit lines.

-

States are set to lay off one million to two million more

people this year.

-

The new European austerity programs, ones which we will have

to adopt as well (and soon!), will reduce consumption and

perpetuate the deflationary spiral.

-

Inflation continues to be subdued despite the massive

government spate of monetary printing presses in overdrive.

-

Overall, more than $10 trillion of consumer and $20 trillion

of corporate credit will vanish.

Inflation misconception:

Given the tremendous amount of borrowing and spending by world

governments, many people feel that inflation is inevitable. It is

true that the government is printing and spending like mad, trying

its hardest to create inflation. However, what is essential for

investors to understand is that the government’s attempts simply

cannot create assets as fast as they are being destroyed. That’s

deflationary, not inflationary. Eventually they will succeed which

will be a concern down the road, but be not for while.

Portfolio Strategy:

This is a very dangerous period, and investors must employ a

"tactical" investment approach, as the old fashion buy-and-hold

(buy-and-hope) approach will again prove disastrous. For instance:

bonds and cash would be decimated by inflation, but may be very

profitable during deflation. On the other hand, a portfolio of

stocks and commodities would do well during inflation, but

catastrophic during deflation. And of course, there will be a time

in the near future where you will want to be in cash, so you must

have an exit strategy.

Read other articles and learn more about

Keith Springer.

[Contact the author for permission to republish or reuse this article.]

|