How Have Your Customers Changed

In The Last Five Years?

By Ross Shafer

First of all, forget the tired, old adage; “The customer is always

right!” Itâs just not true...or even relevant, anymore.

Replace it with, “The customer is always…Vulnerable.”

Customers feel vulnerable, helpless, out of control, and anxious.

That was the clear message we got from them when we dissected 1,000

random customer complaints we found on customer complaint web sites,

blogs, and chat rooms. We didnât edit the complaints. We didnât

solicit them or try to manipulate them. We just read what customers

typed into cyberspace when they had nowhere else to turn for

satisfaction. The complaints were emotionally charged and spoke to

how customers feel before, during, and after the

transaction…with you.

Whatâs Caused This Drama? Your customers get emotional about the

transaction because they need you for something. And, anytime

you need somebody else for something, youâre vulnerable. Somebody

else has the control. Somebody else has the knowledge. Somebody else

has the product, service, or solution you want. Abundant “need” is

the active ingredient for your customer to feel vulnerable,

helpless, and emotional. Face it, you know everything about

your business - the costs, the hidden expenses, and the time

of delivery…but your customer doesnât. He/She needs guidance from

you. He/She needs a livable price, a quote and/or budget from you.

He/She needs you to keep your production deadlines. He/She needs to

keep his boss happy. He/She needs you to make him look smart for

hiring you…so he/she can get some sleep at night. ( I realize using

the “he/she” is annoying but letâs face it He may be a very powerful

She!)

Have

Customers Actually Evolved? Yes! Our company has been making

human resource training films since 1994 and weâve witnessed a huge

shift in the customerâs emotional state; especially since one

shattering event in American history; the 9-11 attack on the Twin

Towers. That morning, Americans saw more than 3,000 of our fellow

citizens vaporized before our eyes. We no longer safe felt safe in

our own country. The convenience of airline travel evaporated.

Homeland Security was established. Retail sales of Taser stun guns,

mace, personal body armor, home security systems, biological weapon

suits, home generators, and firearms instantly tripled. Books like,

Purpose Driven Life - What on Earth Am I Here For? became

overnight best sellers as Americans looked to their faith and

purpose as a way to cope with impending catastrophe. At the same

time, reality TV shows like Survivor, Dog Eat Dog, and

Fear Factor enjoyed staggering ratings as Americans tuned in,

not only for entertainment, but as a weekly lesson in disaster

preparedness.

Today,

America is still on high emotional alert. When the movie trailer for

Universal Pictures “Flight 93” was shown in New York, the AMC-Lowes

in Manhattan made the decision to pull it after viewers said they

found it to be too upsetting. How does this make your customers

feel five years later? The brave ones remain cautious. Some are just

plain scared. But, everyone is irritable if they sense fear or

anxiety if their money, reputation, business, or life is endangered.

Then,

There Is The Human Matter Of Self Sufficiency: Ah, donât let me

forget to mention that the Online Purchase/Kiosk/ATM/Self Checkout

economy is doggedly detaching your customers from your most

important relationship building tool; you. While you may not

be generating and maintaining a lot of bids, business, or service

calls over the Internet today, count on it to infiltrate your

business soon. Online inquiries, bidding submissions, progress

reports, sales, and evaluations are already becoming popular. Saves

time, right? Short term, yes. But, there is an enormous lost

opportunity cost when your customer no longer needs you. Because so

many business people have learned to complete the transaction

themselves with a computer - or through an automated kiosk, it

actually results in less purchase anxiety. Question is…do you really

want your customers to stop needing you?

So,

Whatâs The Fix? Find a mirror. Gaze closely. Itâs You. You have

the power to capture your customerâs loyalty by putting your face in

front of theirs. Learn how to interpret your customerâs emotional

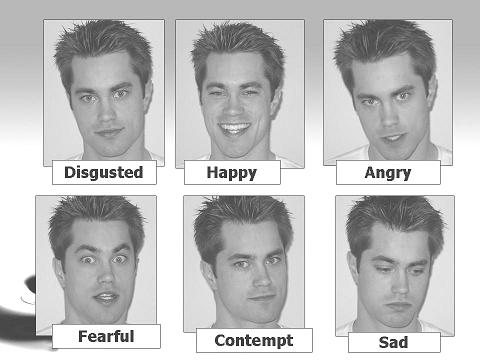

state before, during, and after the transaction. Itâs not difficult. First,

assume your customers donât have all of the answers and are feeling

vulnerable. Next, you can easily read their faces and interpret

their tone of voice by becoming familiar with the top six facial

expressions that telegraph your customerâs “hidden” emotional state.

You do it when youâre playing poker, right? Why not apply the same

study to your customers; without the gambling?

Besides

looking them in the eyes, stop talking. Ask a few non-threatening

questions and really listen to what your customers are telling you.

Avoid the urge to show them how smart you are by jumping in with

something to advance your agenda. Itâs not about you, right

now. Keep it all about them. Donât question your customer if

heâs misinformed. It makes him feel stupid. Rather, take the

position that you may have misheard - then carefully clarify again.

Keep digging deeper with more questions until you are absolutely

clear about his concerns.

The

Customersâ Final Moment: Customers remember how they felt

during the final moment more than at any other time during the

transaction. So make your final moment worth remembering. Naturally,

you want to leave them with a smile and a promise kept. But more

importantly, make them feel like they made the best choice

with you. Positive “final moment feelings” are what will not only

bring that customer back to you, but eliminate your need to compete

on price alone. Customers will pay a premium price to someone who

cares about them. Plus, caring about people is a differentiator that

costs you nothing - yet contributes more to your bottom line than

all other marketing efforts combined.

Read other articles and learn more about

Ross

Shafer.

[This article is available at no-cost, on a non-exclusive basis.

Contact PR/PR at 407-299-6128 for details and

requirements.]

|